AI in Business Intelligence: Unlocking Enterprise-Scale Value

Is your analytics still stuck in late Excel reports, full of manual copying and guesswork? Tired of BI systems that only describe the past instead of predicting the future? Adopt AI in business intelligence to move beyond static dashboards. AI-powered analytics don’t just show what happened — they explain why it happened, uncover hidden patterns, and recommend the next best actions, turning your data into a real decision-making engine.

Data should drive decisions — however, in many companies, it still slows them down. Traditional BI tools weren't built for today's data volumes, fragmented systems, or the speed C-level leaders are expected to operate at. Dashboards are everywhere, and clear answers are not.

AI in business intelligence changes that. By combining advanced analytics, machine learning, and generative AI, businesses can turn complex data into real-time, decision-ready insights. It's why the BI market is expected to grow from $34.27B in 2025 to nearly $52.76B by 2034 — and why over half of companies already use AI in at least one business function, most often analytics.

In this guide, we show how AI is transforming business intelligence from reporting to foresight. You'll see practical use cases, especially in fintech and banking, where AI-powered business intelligence accelerates decisions, reduces risk, and delivers measurable business impact.

What Is Business Intelligence?

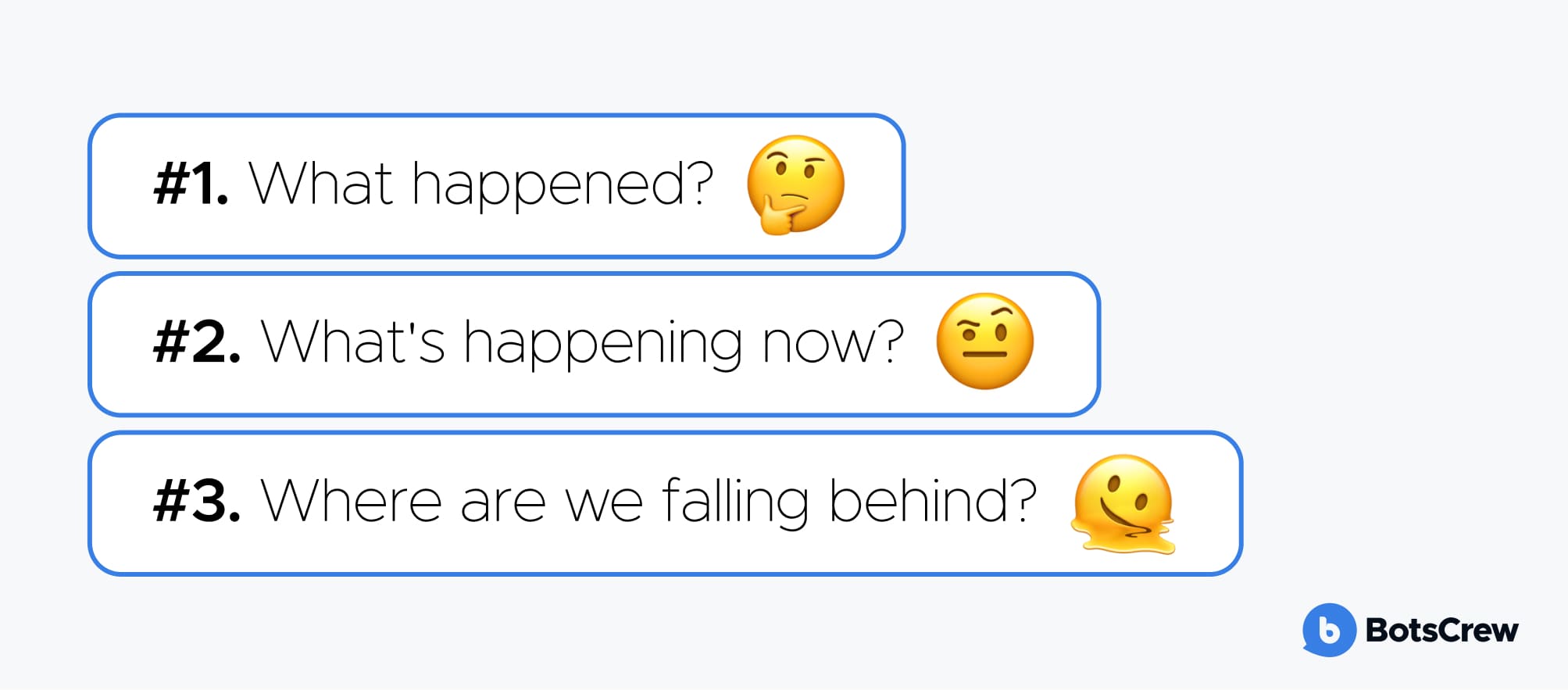

Business intelligence (BI) is the foundation of data-driven decision-making. It encompasses the processes, tools, and technologies that turn raw operational data into clear, actionable visibility for leaders. At its core, BI helps executives answer three critical questions:

Modern BI platforms consolidate data from across the company — sales, finance, supply chain, marketing — and present it through dashboards, reports, and KPIs. This shared, real-time view allows teams to track performance, spot trends early, and respond faster when conditions change.

In practice, BI supports decisions at every level. A retail leader can monitor sales performance by product and location. A CFO can instantly compare budgeted versus actual spend across departments. The value lies in alignment: everyone operates from the exact numbers.

Core components of BI include:

- Data integration and ETL pipelines

- Centralized, executive-ready dashboards

- KPI and metric tracking

- Role-based reporting

- Real-time alerts

BI is essential for understanding the state of the business. But it's retrospective mainly — it shows you what is happening, not what should happen next. That gap is exactly where AI agents come in.

- Interactive visualizations and drill-downs.

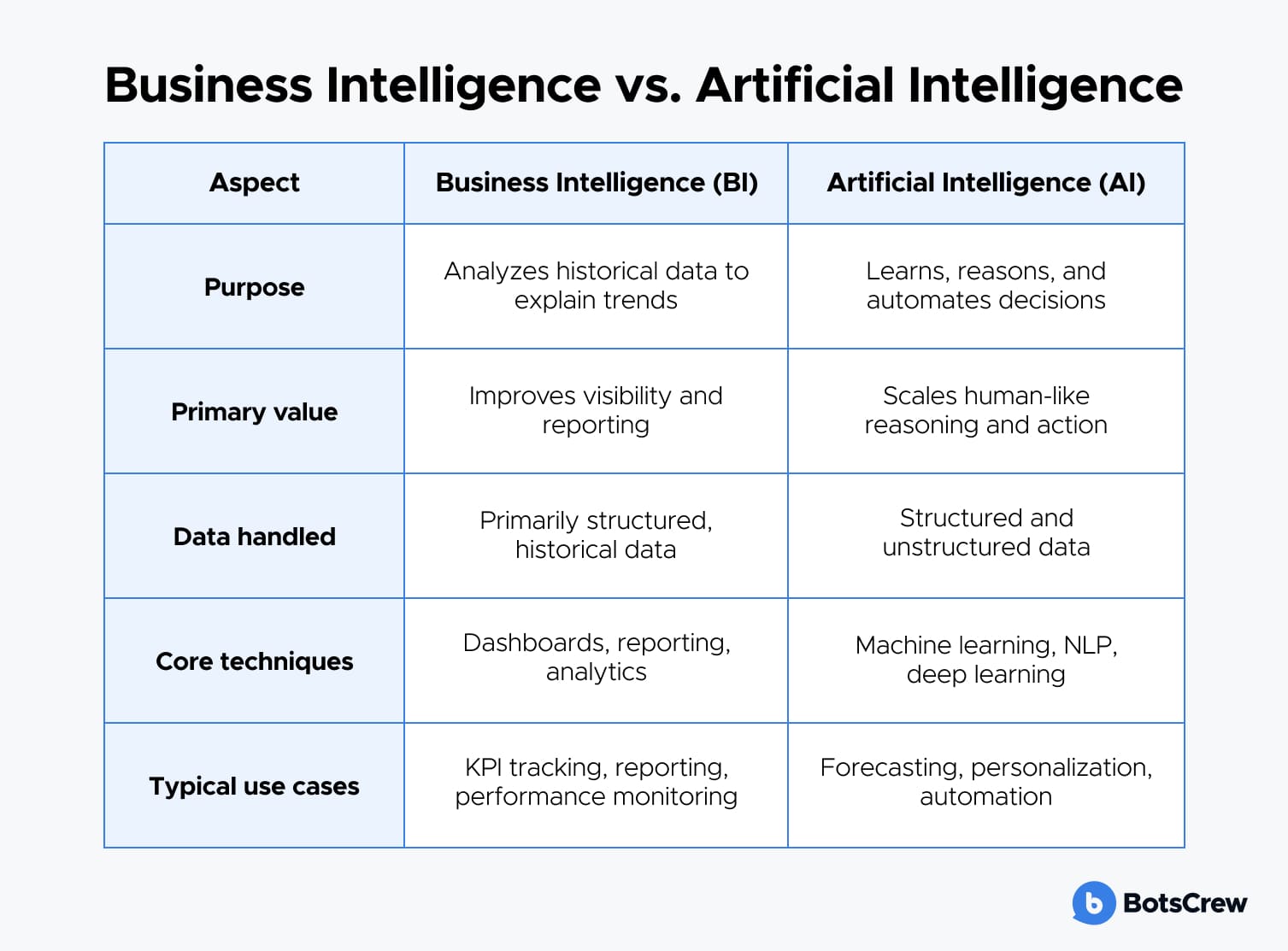

Traditional BI vs. AI-Powered BI: The Role of AI in Business Intelligence

Traditional BI is primarily retrospective. It aggregates structured data, generates dashboards, and answers questions about what has already happened. These insights are helpful in monitoring performance, tracking KPIs, and creating reports, but they rarely guide the "what's next/what-if” decisions that executives need in fast-moving markets. What is the role of AI in business intelligence, then?

AI-powered business intelligence, by contrast, introduces forward-looking intelligence. Modern AI-driven BI solutions can:

✅ Analyze large, complex datasets in real time

✅ Uncover hidden patterns, anomalies, and correlations that manual analysis often misses

✅ Enable accurate self-service analytics, allowing business users to query data using natural language.

Key differentiators include:

Scope of analysis: AI can handle both structured and unstructured data — from ERP systems, social media feeds, IoT sensors, or text-heavy documents — unlocking insights previously hidden.

Timing of insights: Instead of waiting for scheduled reports, AI continuously monitors data in real time, alerting teams to anomalies, risks, or opportunities as they occur.

Decision orientation: AI shows trends and suggests actions and simulates outcomes, embedding intelligence directly into workflows.

With natural language processing (NLP), executives and business teams can also ask questions in plain English — What's driving the margin drop this quarter? Which regions are at risk? — and receive instant, contextual answers. This reduces dependency on IT and data teams, shortens decision cycles, and ensures insights reach the right people at the right moment.

Most importantly, AI-powered business intelligence adapts. Insights can be personalized by role, function, or priority, ensuring leaders see what matters most, without noise.

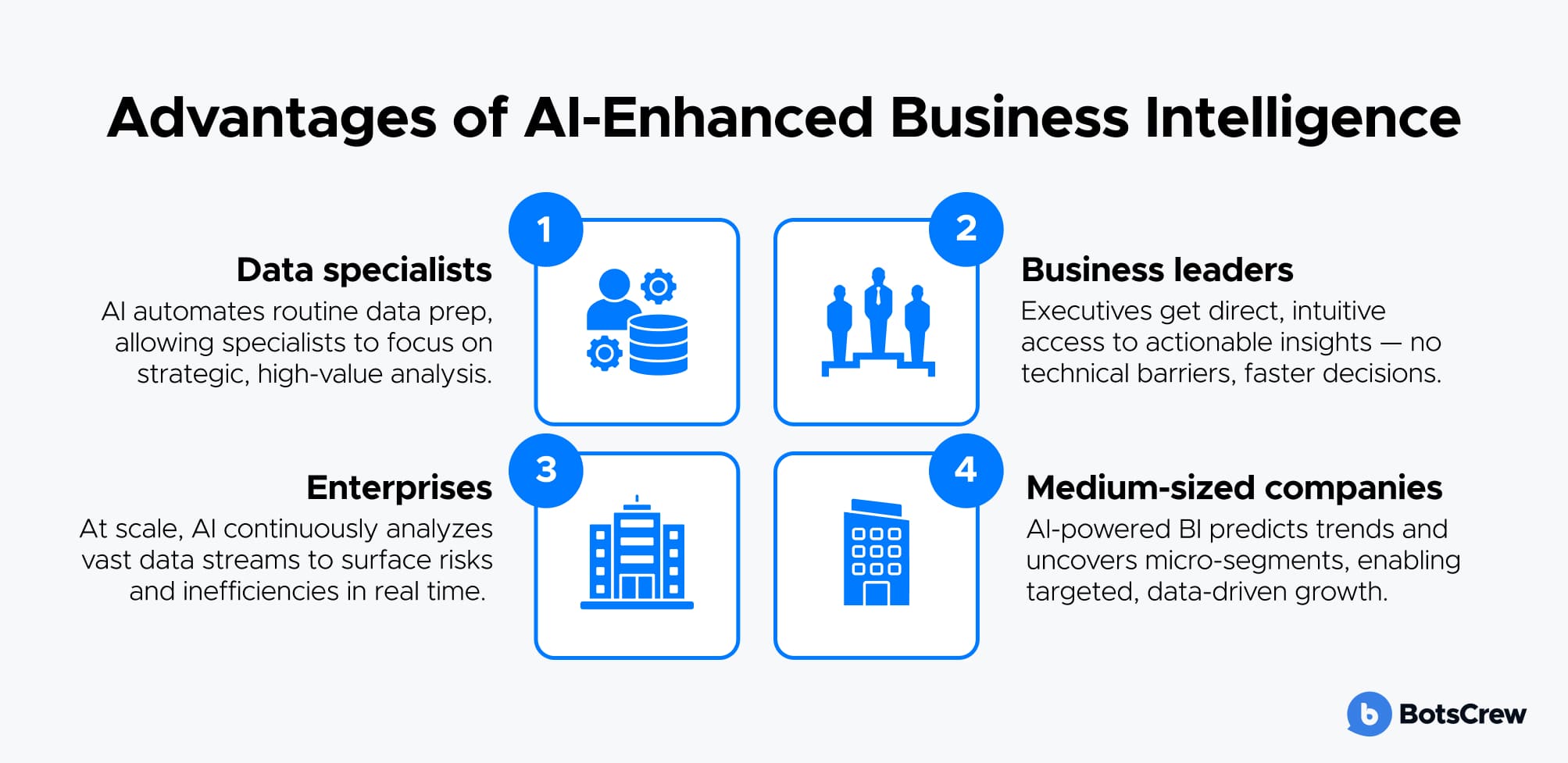

How AI Enhances Business Intelligence: the Value for Business Leaders, Medium-Sized Companies & Enterprises

Instead of asking teams to interpret dashboards, AI-enabled BI interprets the data itself. It connects signals across systems, understands context, and surfaces insights at the moment decisions need to be made.

What changes at an organizational level:

→ Data teams move from reactive service providers to strategic partners

→ Analytical capacity scales without proportional headcount growth

→ Knowledge becomes institutionalized in models, not individuals.

Impact for Business Leaders

For executives, the biggest limitation of traditional BI is timing and relevance. Insights arrive late, lack context, or require interpretation before they can inform action.

Business intelligence and AI compress this gap. Leaders can engage directly with data in natural language, explore “what-if” scenarios, and understand causal drivers. More importantly, AI systems can recommend actions based on historical patterns and real-time signals, effectively embedding decision intelligence into daily operations.

For instance, a regional retail director notices declining margins in one market but can't immediately see why. Instead of waiting for an analyst's report, they ask the BI system: “Why did margins drop in the Northeast this month, and what happens if we adjust pricing by 3%?”

The AI-powered BI system instantly analyzes sales data, supplier costs, promotional activity, and regional demand. It identifies a combination of increased logistics costs and over-discounting on low-margin products as the primary drivers.

The system then runs a what-if scenario, showing that a targeted price adjustment on specific SKUs would recover margin with minimal impact on volume. Based on historical outcomes and real-time signals, the AI recommends a particular action of pricing, flags potential risks, and estimates the financial impact.

Decisions become less episodic and more continuous. Risk is identified earlier. Strategy becomes adaptive rather than static.

What changes at an executive level:

→ Decision cycles shorten from weeks to hours or minutes

→ Intuition is augmented, not replaced, by probabilistic reasoning

→ Management attention shifts from explanation to intervention.

Impact for Medium-Sized Companies

Mid-sized organizations often face a structural disadvantage: less data, fewer analysts, and limited forecasting capability. By applying machine learning to customer behavior, pricing, demand, and channel performance, AI allows mid-sized firms to operate with enterprise-level intelligence, without enterprise-level complexity.

Predictive insights enable earlier course correction, while prescriptive analytics guide resource allocation with greater precision. AI helps leadership concentrate on the few variables that truly drive growth, rather than tracking dozens of vanity metrics.

What changes at a growth stage:

→ Strategy becomes evidence-led rather than intuition-driven

→ Marketing, sales, and operations align around shared predictions

→ Scaling decisions are based on probability.

Impact for Enterprises

At enterprise scale, the challenge is data coordination. Data lives across silos, decisions are distributed, and risk accumulates quietly. Business intelligence and AI act as a connective layer across the organization. It continuously monitors signals from thousands of data streams, identifies systemic risks, and surfaces insights at the right level of granularity — global for executives, operational for teams.

For example, a global fintech operates across multiple regions with separate transaction systems and regulatory requirements. Instead of relying on delayed, siloed reports, the company uses AI-powered BI as a connective layer across payments, customer activity, and compliance data.

The system continuously monitors real-time signals and detects emerging anomalies that may indicate regulatory risk. When an issue arises, AI surfaces insights at the right level: executives see potential exposure, compliance teams get detailed transaction context, and operations receive recommended control actions.

Every step is automatically logged, creating a clear audit trail. Compliance shifts from reactive reporting to proactive risk management, reducing regulatory exposure while improving operational efficiency.

In regulated industries such as fintech, this intelligence becomes critical. Compliance shifts from a defensive function to an operational advantage.

What changes at enterprise scale:

→ Insights propagate consistently across business units

→ Risks are detected earlier, when intervention is still cheap

→ Compliance and performance management converge.

BotsCrew recommendations

✅ Implement role-based intelligence access, not one-size-fits-all dashboards.

✅ Continuously audit AI models for drift, bias, and regulatory alignment.

✅ Build closed-loop systems where human feedback improves model accuracy over time.

✅ Treat AI-powered BI as critical infrastructure, not a side initiative.

Examples and Use Cases of AI Agents in Business Intelligence

Even in organizations at an early stage of adoption, AI agents can be introduced incrementally within existing BI platforms. The following examples illustrate the application of AI in business intelligence and how AI enhances BI across industries.

Retail

Agent type: Inventory Optimization Agent

How it works: The agent continuously ingests point-of-sale data, inventory levels, supplier lead times, seasonal patterns, and regional demand signals. It compares real-time performance against historical baselines and predictive demand models. When deviations occur — such as slower sell-through or sudden demand spikes — the agent evaluates multiple response options.

Rather than simply alerting teams, it recommends specific actions: reorder quantities, pricing adjustments, or targeted promotions. These recommendations are prioritized based on margin impact, storage constraints, and supply chain risk.

Why it matters in BI: Inventory dashboards become dynamic decision tools. Instead of reviewing lagging indicators, teams act on forward-looking recommendations tied directly to revenue and cash flow.

Healthcare

Agent type: Patient Readmission Risk Agent

How it works: The agent analyzes a combination of historical patient data, treatment protocols, discharge notes, and real-time clinical indicators. It continuously recalculates readmission risk as new data becomes available, factoring in social determinants of health and past intervention outcomes.

When risk thresholds are exceeded, the agent recommends tailored follow-up actions — post-discharge outreach, medication reviews, or care plan adjustments — based on what has worked for similar patient profiles.

Why it matters in BI: Clinical BI evolves from retrospective reporting to proactive care orchestration, enabling earlier intervention while supporting regulatory compliance and cost control.

Not sure if your data is ready for AI? Our consultants will review your data processes and outline the fastest path to trustworthy, AI-powered analytics.

Financial Services

Agent type: Fraud Detection Agent

How it works: The agent monitors transactional data streams across channels, building behavioral profiles for accounts, merchants, and devices. It flags anomalies by comparing current behavior against both historical patterns and peer benchmarks. Over time, it learns from confirmed fraud cases and false positives, refining its detection logic.

Beyond alerts, the agent can recommend graduated responses — ranging from silent monitoring to transaction holds or escalation — based on risk level and customer value.

Why it matters in BI: Risk dashboards shift from static summaries to live defense systems, balancing fraud prevention with customer experience and operational efficiency.

SaaS and Technology

Agent type: Churn Prevention Agent

How it works: The agent analyzes user behavior patterns, feature adoption, support interactions, renewal timelines, and sentiment data such as NPS or customer feedback. It detects subtle changes — declining usage, unresolved tickets, or disengagement — that precede churn.

Based on these signals, the agent recommends tailored retention strategies: proactive outreach, onboarding interventions, feature education, or commercial incentives, prioritized by revenue impact.

Why it matters in BI: Customer analytics shifts to proactive revenue protection, enabling teams to intervene before churn becomes inevitable.

Logistics

Agent type: Delivery Optimization Agent

How it works: The agent monitors carrier performance, route efficiency, delivery SLAs, fuel costs, and real-time disruption data. It evaluates alternative routing, carrier allocation, or contract adjustments based on price, reliability, and service impact.

Over time, it builds a performance history that supports renegotiations and strategic sourcing decisions grounded in objective data.

Why it matters in BI: Logistics BI evolves into a continuous optimization system, supporting operational decisions and long-term cost control simultaneously.

What These Use Cases Reveal

Across industries, generative AI in business intelligence introduces a new layer of intelligence:

→ Continuous sensing instead of periodic reporting

→ Context-aware recommendations instead of raw metrics

→ Actionable outputs aligned with business priorities.

As BI platforms increasingly support native agent orchestration, organizations can scale these capabilities across finance, operations, marketing, HR, and compliance.

AI agents will increasingly function as embedded decision partners. For executives, the key question is not whether AI agents belong in BI, but which decisions should be augmented first to deliver the highest strategic and financial return.

4 Critical Mistakes That Turn AI Integration Into a Risk

AI has the power to transform Business Intelligence — but the stakes are high. Missteps in AI adoption slow progress, can misguide decisions, waste millions, and damage your company's reputation. This section exposes the top mistakes that turn AI projects from strategic opportunities into operational risks.

#1. Poor Data Quality and Bias

Using incomplete, inaccurate, or biased historical data to train models.

Consequences: AI models inherit and amplify existing biases, leading to discriminatory decisions and inaccurate predictions.

A retailer deploys AI for personalized discounts based on historical purchase data. The model inadvertently reduces offers to certain demographic groups due to biases in past transactions, resulting in lost customers and reputational damage.

#2. Lack of Clear Business Objectives

Implementing AI for the sake of AI, without defining a specific business problem to solve.

Consequences: Projects become expensive pilot initiatives that fail to deliver measurable value or scale effectively.

A financial firm invests in a complex market forecasting model without clarifying which problem it should address. While the team generates visually impressive dashboards, the insights are not actionable for trading or risk management, making the investment ineffective.

#3. Over-Automation and Ignoring the Human Factor

Unquestioningly trusting automatically generated insights, visualizations, or data preparation processes.

Consequences: AI may incorrectly remove important outliers, misinterpret correlations as causal relationships, or suggest ineffective dashboard designs, requiring constant manual intervention.

A manufacturing company uses AI to predict equipment failures. The model automatically filters out “anomalies” as noise, missing key signals of impending breakdowns, which leads to unplanned downtime and production losses.

#4. Ignoring Context and Drawing Incorrect Conclusions

Failing to evaluate AI outputs within the real business context critically.

Consequences: High rates of false positives or false negatives distract teams and result in missed critical events.

A logistics company uses AI to detect anomalies in deliveries. The model repeatedly flags delays due to minor weather variations that do not impact KPIs. Teams spend hours investigating non-issues instead of focusing on genuine supply chain risks.

All these challenges can be mitigated with a trusted AI partner who brings both technical expertise and business insight, ensuring that AI initiatives are strategically aligned, scalable, and positioned to deliver measurable ROI as they mature. We at BotsCrew partner with the world's largest companies, providing data analytics solutions that drive smarter, faster business decisions.

Our portfolio includes projects for global enterprises and industry leaders — companies whose products you see on store shelves or use every day. We back our expertise with scale and results: on request, we can share internal case studies that showcase our approach and the measurable impact of projects most relevant to your business.

How Can You Start?

Start with a conversation. You can book a call with our AI consultants to explore how AI agents can deliver the highest ROI for your business. We'll help you identify where AI-driven BI can create immediate impact — whether that's faster decision-making, better visibility into performance, or reduced reliance on technical teams.

Our experts will walk you through practical, high-value use cases tailored to your data, teams, and goals. You'll see how AI agents enable business users to ask questions in plain English and receive instant, actionable insights — without SQL, dashboards, or technical complexity.

Together, we'll:

- Identify the most profitable AI-powered BI use cases for your company

- Define where conversational analytics can replace manual reporting

- Map AI insights directly to business decisions and outcomes

- Ensure solutions scale securely across teams and functions.

Book a call to explore how AI-powered BI can start delivering value from day one.